Статьи

методические материалы

«Impact of banking real estate as an asset class on financial system stability: monitoring, forecasting, management»  (Опубликовано в Journal of Reviews on Global Economics (Канада, SCOPUS), 2018, 7)

(Опубликовано в Journal of Reviews on Global Economics (Канада, SCOPUS), 2018, 7)

Презентация доклада здесь

«Impact of banking real estate as an asset class on financial system stability: monitoring, forecasting, management»

Authors:

Sternik S.G., ScD (Economics), Professor of the Financial University under the Government of Russian Federation, Moscow, Russia

E-mail: sergey-sternik@yandex.ru

Teleshev G.V., Director, Department of strategy and corporate development, VTB Bank PJSC, Moscow, Russia

E-mail: gteleshev@gmail.com

Financial crisis of 2007-2008 in the United States made international community recognize the nature of risky interconnectedness between real estate markets dynamics and global financial markets health given the fact that it started as a mortgage crisis first. Due to underestimation of risks inherent for real estate markets, the worst case scenario of national and international economic crisis (as reflected in decreasing industrial indicators, employment and consumption) was not avoided, which subsequently resulted in financial (steep decline in assets prices) and finally, banking crisis (insolvency of banking institutions reflected in their ability to meet financial obligations).

One of the most important reactions to the crisis by the international financial regulators was the revision of capital requirements for banking institutions codified in revised Basel III standards, which are almost universally believed to be able to affect real estate markets dynamics due to the more conservative approach of many financial institutions towards loans secured by the real estate.

However, realization of systemic interconnectedness between real estate markets dynamics and financial markets stability is not limited to more stringent capital requirements for real estate loans (as well as structuring of complex derivatives with real estate as collateral). Regulators (both in Russia and internationally), serving as systemically important consumers of academic research on the real estate markets and financial stability, increasingly recognize that real estate as an asset class plays a more significant role in financial system stability than was previously thought (particularly before 2007-2008 financial crisis in the United States). Given the above, we believe that financial regulators may, in setting their overall policy, greatly benefit from solution of the very important practical and scientific problem – namely, determination of the level of influence and corresponding mechanisms of the real estate markets values dynamics on financial system stability.

Additional factor, which increases the necessity for more in-depth and systemic study of the real estate markets for the purposes of setting banking sector regulations, are characteristics of real estate markets as predominantly local, cyclical in nature as well as characterized by relatively inelastic demand and considerable information asymmetry of information on real estate transactions. This, in turn, present a unique challenge for regulators in developing comprehensive regulatory instruments tailored towards complexity and considerable segmentation of banking real estate portfolios as well as factoring in potential impact of real estate markets volatility on banking sector stability.

2. State of research on the subject internationally

Following mortgage crisis in the United States in 2007-2008, it was almost universally accepted that real estate not only represents real (i.e. tangible) asset, but also comprises a considerable portion of the debt markets (in the form of both mortgages and mortgage-backed securities) as well as equity markets (in the form REITs). Therefore, for example, Moody’s international rating agency included real estate portfolio cash flow volatility ratings into other their non-credit ratings group (Fedotova, Sternik, Latkin (2017)).

Growing recognition of the role of the real estate markets for financial markets stability is also reflected in academic activity, including organization of international expert discussions and conferences that bring together representatives of central banks, international organizations, academic community and monetary regulators who jointly seek solutions of creating adequate regulatory framework for managing risks associated with the real estate markets volatility.

On the most notable conferences on the subject matter, which underlined high level of attention to the subject of the real estate markets and financial stability was the conference jointly organized by the Bank for International Settlements and the Monetary Authority of Singapore, which brought together representatives of the South Pacific central banks, International Monetary Fund and academic circles of the United States and the United Kingdom titled “Property markets and financial stability” (BIS Papers, No 64 Property markets and financial stability, https://www.bis.org/publ/bppdf/bispap64.pdf). Conference that was organized by the “central bank of central banks” was structured around four key themes:

1. Lessons from the crisis (Note: financial crisis of 2007-2008);

2. House price assessment;

3. Housing booms and busts;

4. Property, credit and markets.

Combination of key themes, which is otherwise quite untypical of central banks’ usual research focus, is as worth noting as the thesis of particular papers presented. For example, in his paper “Dealing with real estate booms and busts”, Deniz Igan, an economist in the International Monetary Fund (IMF) Research Department’s Macro-Financial Linkages Unit, notes:

«Real estate is an important, if not the most important, storage of wealth in the economy. Additionally, the majority of households tend to hold wealth in their homes rather than in equities. Typically, in advanced economies less than half of households own stock (directly or indirectly), while the home ownership rate hovers around 65 per cent. In addition, the supply-side effects can be substantial. In most advanced economies, house price cycles tend to lead credit and business cycles (Igan et al (2009)). This suggests that fluctuations in house prices create ripples in the economy through their impact on residential investment, consumption and credit, while the reverse effect is not as prominent, implying that the housing sector can be a source of shocks. Recessions that coincide with a house price bust tend to be deeper and last longer than those that do not, and their cumulative losses are three times the damage done during recessions without busts (emphasis is ours). Again, by contrast, recessions that occur around equity price busts are not significantly more severe or persistent than those that do not (Claessens et al (2008))».

Such observations made by the author do not only illustrate a prominent role that real estate as an asset class plays in financial crises, but also recognizes the fact that real estate market volatility plays a central role plays a central role in the most protracted and damaging episodes of recessions. Such conclusions are based on the deep understanding of the most crucial characteristics of real estate markets: relative illiquidity of the real estate assets, low transparency or real estate transactions data, significant negative externalities (i.e. considerable influence on unemployment and population mobility) of real estate crises.

3. State of research in Russian academia and financial industry practice

In analyzing state of research in the field of interconnectedness between real estate markets and financial stability in Russia one has to bear in mind that financial industry is rapidly changing due to technological change as well adoption as the adoption of Basel III regulatory framework by the banking regulator and financial industry. Russian central bank implements tools for managing risks, which are typically associated with real estate markets (for example, as part of Basel III implementation, Russian banks with considerable real estate portfolios prepare and implement risk management policies for real estate portfolio valuation risks, while Russian central bank retains the right to, for example, examine real estate assets used as a collateral under mortgage and other types of loans).

Having said that, we observe a certain shortage of studies tailored towards understanding and exploring systemic linkage between stability of financial industry and dynamics and level of development of the real estate market. Additionally, we observe, there are certain traits of Russian economy overall, real estate market and financial industry, which are otherwise untypical of more developed economies and which potentially increase the necessity for such studies, i.e.:

· Uneven development of the local real estate markets across Russia and, as a result, concentration of the most progressive technologies and competencies of real estate management and valuation within the most developed ones (i.e. Moscow, Saint Petersburg being at the forefront of this process, while regional markets significantly lagging behind them). This, in turn, makes development of relatively universal systemic tools particularly challenging for policy-makers, particularly for local real estate markets that are considered “narrow” (i.e. characterized by the very limited demand, level of development and available transaction data and an increased information asymmetry);

· Relatively high risk appetite for real estate as an asset class among Russian banks compared to international financial groups (Fedotova, Sternik, Teleshev (2015));

· Rapidly changing geopolitical environment and various sanctions measures and as a result, shrinking presence of international players that typically create demand for progressive methods and technologies of valuation and real estate management. On the other, potentially suppressed demand for such technologies among Russian players given lower prospects of capital raising on international markets that typically reward high level of development of such technologies in company’s intangible assets portfolios.

At the same time, we believe, that significance of studies of real estate markets impact on financial stability is amplified given their systemically significant nature, particularly under such challenging circumstances. There is also an additional degree of significance attached to developing and maintaining such expertise within the banking sector, given its potentially shrinking foothold elsewhere.

4. Basic definitions of real estate accounting and valuation of banking real estate in Russian financial industry

Accounting and valuation of banking real estate in Russia is regulated by the Central Bank of Russian Federation, Regulation #448-P “On Credit Institutions’ Accounting of Fixed Assets, Intangible Assets, Real Estate Temporary not Used in Operational Activity, Long-Term Assets Held for Sale, Inventories, Means and Objects of Labor of Undetermined Purpose Obtained under Compensation or Pledge Agreements”, effective from 01.01.2016 (hereinafter referred to as 448-P).

According to paragraph 4 of 448-P, determination of fair value of fixed assets, intangible assets, real estate temporary not used in operational activity, long-term assets held for sale, inventories, means and objects of labor of undetermined purpose obtained under compensation or pledge agreements is undertaken in accordance with IFRS 13 “Fair Value Measurement”, which was endorsed together with other IFRS standards by the Government of Russian Federation in 2011: https://www.iasplus.com/en/binary/europe/1103russianifrsendorsementenglish.pdf.

As per IFRS 13, paragraphs 61-66, market approach valuation methodology contains reference to multiplier market models: “The market approach uses prices and other relevant information generated by market transactions involving identical or comparable (i.e. similar) assets, liabilities or a group of assets and liabilities, such as a business. For example, valuation techniques consistent with the market approach often use market multiples derived from a set of comparables. Multiples might be in ranges with a different multiple for each comparable. The selection of the appropriate multiple within the range requires judgement, considering qualitative and quantitative factors specific to the measurement. Valuation techniques consistent with the market approach include matrix pricing. Matrix pricing is a mathematical technique used principally to value some types of financial instruments, such as debt securities, without relying exclusively on quoted prices for the specific securities, but rather relying on the securities’ relationship to other benchmark quoted securities.».

Stated provisions of IFRS 13, in our view, de facto ignore provisions contained in Russian legislation regulating valuation methods and process in Russian Federation, which operate with such definitions as a “market” value or “cadastral” value, but not “fair” value of real estate assets. Aside from that, regulator states that banking institutions determine methods of fair value measurement in internal standards or other internal documents, which also runs contrary to valuation legislation. Quite possibly, such legal inconsistencies will be addressed in future to avoid facilitating corruption and economic conflict of interest of market participants. For the purposes of this study, we will therefore operate under the assumption that differences between “fair” and “market” value definitions are negligible and both definitions can be used interchangeably.

For the purposes of the further discussion, we need to consider basic definitions of various of types of bank’s balance sheet the can potentially contain real estate according to 448-P.

· In our assessment, real estate on Russian banks’ balance sheets is most commonly held within three major categories, which we will discuss further in more details:

fixed assets;

real estate temporary not used in operation activity;

long-term assets held for sale.

· Fixed assets. Asset is considered a fixed asset if it has a material form (i.e. tangible asset), intended of the use by the credit institution for the provision of services of administrative purposes for at least 12 months and the sale of such asset is not planned, while asset is deemed to be meeting the following set of criteria (simultaneously):

asset can provide economic benefits to the credit institution in the future;

asset value at recognition can be safely determined.

· Real estate temporary not used in operation activity (hereinafter referred to as NVNOD after Russian abbreviation of the same – Nedvizhimost’ Vremenno Neispolzuemaja v Osnovnoy Deyatelnosti). Asset is classified as NVNOD (or part of the asset – land parcel, building or its part or both), owned by the credit institution, received by the credit institution as part of its activities under credit institution charter and intended to generate rental income (excluding, however, financial leasing) or capital appreciation of the asset or both, excluding uses within credit organization as means of labor for the provision of services, administrative purposes, security measures, protection of environment or sanitation and technical regulations uses. Asset disposition should not be planned within 12 months from the date of classification of the asset as NVNOD.

Asset should meet the following set of criteria (simultaneously) to be classified as NVNOD:

asset can provide economic benefits to the credit institution in the future;

asset value can be safely determined.

· Long-term assets held for sale. Fixed assets, intangible assets, real estate temporary not used in operational activity, means and objects of labor of undetermined purpose obtained under compensation or pledge agreements are classified as long-term assets held for sale if reimbursement of their value will take place within 12-months period through the sale of the asset from the date of classification of the asset as long-term asset held for sale and not through the continued use of the asset and under the following conditions:

long-term asset is prepared for immediate disposition in its current state on prevailing market conditions for the sale of comparable assets;

decision regarding sale of the asset is made (long term asset disposition plan is approved) by the head of the credit institution (or his replacement or other authorized person);

credit institution is looking for a buyer with a price comparable with asset fair value;

actions of the credit institution required to complete disposition of the asset (its disposition plan) demonstrate that alterations to disposition decision or its cancelation will not take place.

· In the event asset contains several parts (components) with significantly varying useful lives, each part (component) is recognized as separate inventory object if its value comprises significant part of the overall fixed asset value. Part (component) may have material form or represent expenses for major repairs or technical inspection of the asset, irrespective of whether any replacement of the elements of the asset takes place. Expenses for major repairs or technical inspections are recognized as separate part (component) of the asset only if they happen on a recurring basis throughout useful life of the asset.

· Aggregated asset value. Aggregated asset value is defined as a sum of the items’ values integrated into one accounting unit by common characteristics and their intended use. Credit organization is within its rights to integrate several items with common characteristics and intended use, which are separately considered immaterial.

· Useful life of the asset. Useful life is defined as a period of time when credit organization retains the asset for purpose of extracting economic benefits. Real estate value is reimbursed throughout useful period of the asset by accrual of depreciation. Useful life period is determined by the credit organization based on the following:

anticipated period of the asset use based on its assessed productivity or capacity;

anticipated physical deterioration of the asset, depending on its operating mode, natural conditions and aggressive environment, maintenance schedule;

legal and regulatory limitations on the use of the asset;

obsolescence of the asset, resulting from improvements in industrial process or as a result of the changing demand for the services provided using the asset.

· Value at recognition. Value at recognition for real estate assets received on a reimbursable basis, is recognized as a sum of actual costs incurred by the credit organization during asset construction, creation (production) and acquisition, excluding value-added tax and other reimbursable taxes.

· Until the moment asset is ready for the use by the credit organization in accordance with credit organization management intentions, actual costs incurred by the credit organization are recognized as fixed assets unfinished capital expenditures and categorized into separate group within fixed assets as well accounted separately as balance sheet account #60415 “Expenditures for construction, creation (production) and acquisition of the fixed assets”.

· Depreciation. Depreciation is defined as systematic repayment of the asset depreciable value throughout its useful life period. Depreciable value is determined as either value at recognition or revalued amount minus calculated liquidation value. Fixed assets represented by land parcels are not depreciated. Real estate temporary not used in operational activity and accounted on the fair value basis are not depreciated. Long-term assets held for sale are not depreciated.

· Calculated liquidation value. Calculated liquidation value is defined as amount, which credit organization would receive by the end asset useful period by its disposition minus estimated disposition costs. Calculated liquidation value, useful life period and depreciation method are revised at the end of every reporting year.

· Future costs for fulfillment of liabilities for dismantling, liquidation and environment restoration on occupied land parcel should be assessed by the credit organization and included as part of the fixed asset value at recognition so that the credit organization could reimburse such costs throughout the asset useful life period even if such costs are incurred at the end of useful life period of the asset. These costs are required to be recognized as non-credit estimated liabilities and accounted for on balance sheet account # 61501 “Reserves – non-credit estimated liabilities”. Aforementioned liabilities are accounted for on a discounted value basis using discount rate, factoring in prevailing financial market conditions and premiums specific to such risks and which were not factored in during future costs calculations.

· Credit organization may use one of two methods of valuation of its real estate assets for the groups of similar assets: value at recognition minus accumulated depreciation and accumulated value impairment or at revalued amount.

In accordance with accounting model at revalued amount, fixed asset with fair value that can be safely determined must be accounted for at revalued amount after asset’s initial recognition. Revalued amount is understood as the asset fair value on the date of revaluation minus accumulated depreciation and value impairment. Expenditures for construction, creation (production) and acquisition of the fixed assets, accounted for on the balance sheet account #60415 are not subject to revaluation.

In determination of revalued amount for the fixed assets, a variety of sources of information can be used, i.e.: prices for comparable assets on active market, prices published in the media or professional literature, expert judgements and so on.

· Credit organization approves, as part of its accounting policy, one of the following methods of its real estate assets revaluation accounting:

proportional recalculation of the fixed asset value, reflected on the balance sheet on the reporting date as well as accumulated depreciation of the asset, which is carried out by applying recalculation coefficient. Recalculation coefficient is defined as fair value of the asset on the date divided by its book value minus accumulated depreciation on the same date. Under this accounting method, difference between book value of the asset reflected on the balance after revaluation and recalculated asset’s value using coefficient, equals to the asset fair value.

reduction of the revalued asset amount, reflected on the balance sheet on revaluation date by the accumulated depreciation with subsequent recalculation of the revalued amount to assets fair value. Under this accounting method, book value of the asset, reflected on the balance sheet on revaluation date equals to its fair value, while accumulated depreciation equals to zero.

· Restoration of the real estate asset may be carried out via repairs, modernization or reconstruction. Costs incurred by the credit organization for restoration of real estate temporary not used in operational activity via repairs are recognized within the same period they take place as current expenditures. Costs for restoration of real estate temporary not used in operational activity via modernization or reconstruction increase restored asset’s book value.

5. Structure and value analysis of Russian financial industry real estate assets

As demonstrated in Table, as of the end of 2017 book value of real estate assets of all types outright held by the Russian banks amounted to 1,07 trillion rubles (at fair value in accordance with 448-P), which equaled to 1,26% of the total Russian banking system assets. Both the absolute amount and its share of the total banking system assets demonstrated stability throughout 8 quarters included into dataset (spanning 2017-2018). Variation in total real assets held on Russian banks books was between 1,04 and 1,08 trillion rubles, while in total banking assets varied between 1,26% and 1,33% (variation, most likely, is not so much due to acquisition or disposition or real estate assets by the banks is due to revaluation practice, which we will discuss further). It is noteworthy that aggregate book value of the real estate assets on banks’ balance sheets did not decrease simultaneously with the number of credit organizations in the banking system, but actually increased by almost 35 billion rubles, which in our opinion, shows that real estate assets demonstrate tendency to concentrate within fewer large banking institutions.

Book value of the real estate held as fixed assets amounted to 811,83 billion rubles (or 75,8% or all real estate assets outright held by the Russian banks), out of which 16,91 billion rubles corresponded to land book value.

Book value of the real estate held as long-term assets held for sale is estimated at roughly 73,77 billion rubles (or 6,9% of all real estate assets held outright by the banks).

Finally, real estate held as NVNOD (real estate temporary not used in operational activity), estimated at “fair” value as per IFRS 13 and 448-P Regulation was 185,25 billion rubles (or 17,3% of all real estate held outright), including 6,43 billion rubles allocated by the banks for possible losses provisions .

Quite evidently, real estate temporary not used in operational activity mostly represents real estate assets repossessed by the banks as part their bad debts workout strategy and which is not used by the banks in their day-to-day activities and thereby serving as an economic encumbrance on the banking system. To a smaller extent this represents real estate previously used in operational activity, excluded from fixed assets and operational due to various reasons and not yet disposed of.

The smallest part (13,53 billion rubles or 7,3% of the total NVNOD category) of the banking real estate assets held outright is represented by construction in progress, which we estimate to be mostly former development projects repossessed by the banks rather than construction for the banks’ own use in their operational activity.

Another part of real estate temporary not used in operational activity are real estate assets under current leases (15,11 billion rubles or 8,2% of NVNOD as land and 61,01 billion rubles or 19,9% of NVNOD as real estate excluding land). Presence of real estate leased out by the banks may in part compensate for overall potential losses, however it does not represent banking system core activity.

From the data discussed above, at first, one could conclude that real estate assets held outright (i.e. 1,26% of the total assets) do not represent a significant portion and therefore do not pose a significant threat of destabilizing banking sector under the worst case scenario of the real estate portfolio devaluation. However, an additional analysis has to be made to demonstrate concentration of the real estate assets held outright and corresponding risks by individual banks (at least with a focus on the biggest, systemically significant predominantly state-owned banks).

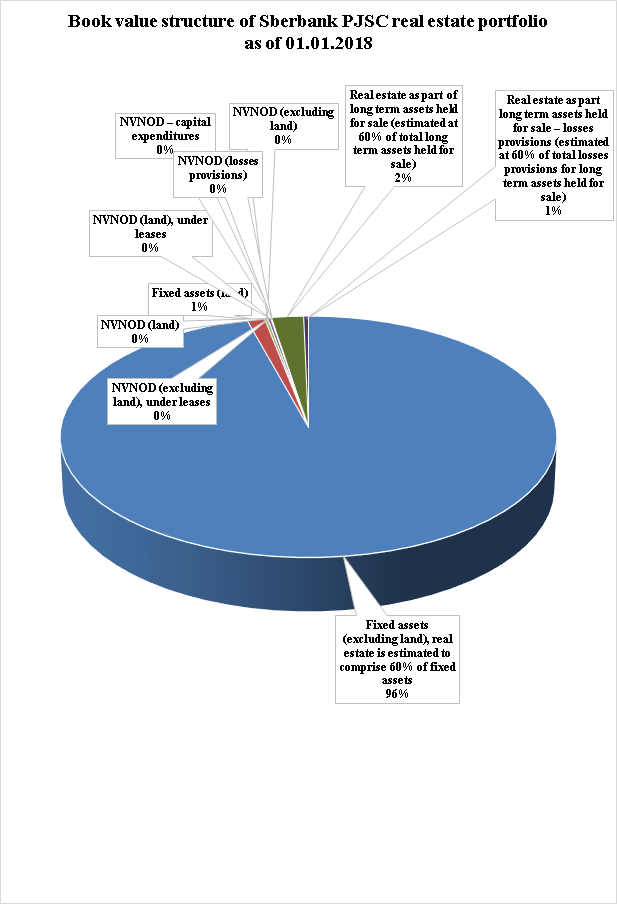

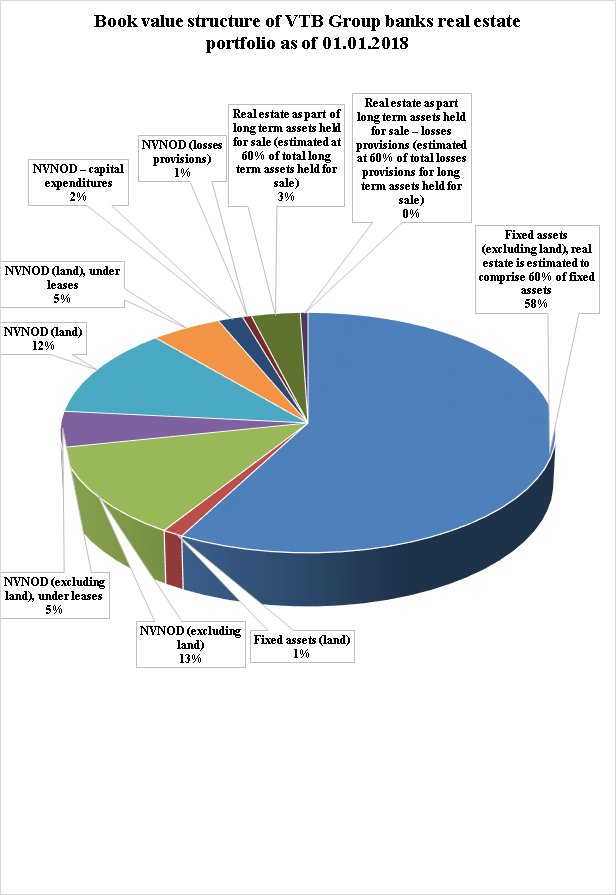

Table 2 contains comparative analysis of book value of real estate assets held outright by Sberbank PJSC and VTB Group banks (VTB Bank PJSC, Bank VTB 24, BM-Bank) as of 01.01.2018.

As demonstrated by the data in Table 2, total book value of the real estate assets held outright by the these banks amounts to 520,82 billion rubles or 49% of all real estate held outright by the entire Russian banking system. We also note that portfolio structures of these banks are significantly different from each other.

Diagram

1 illustrates that majority of Sberbank PJSC real estate assets held outright are

represented by real estate as part of fixed assets, whereas in VTB Bank PJSC and

other VTB Group banks’ (VTB 24, BM Bank) case, only 59% of all assets is represented

by the real estate as part of fixed assets, 4% as part of long-term assets held

for sale and the rest 37% is held in real estate temporary not used in operational

activity.

Table 2.

Comparative analysis of selected balance sheet chapters of Sberbank PJSC and VTB Group banks (VTB Bank PJSC, Bank VTB 24, BM Bank) as of 01.01.2018, according to reporting forms of the Central Bank of Russian Federation (Form 101), billions of rubles

Diagram1. Book value structure of Sberbank PJSC real estate portfolio

Diagram 2. Book value structure of VTB Group banks’ real estate portfolio

It is therefore safe to assess that in VTB Group case, there are significant risks of potential losses as well as the higher share of inefficient costs associated with ownership of non-core assets compared to Sberbank PJSC. Additionally, risks associated with potential devaluation of the real estate assets utilized outside of the highest and best use concept are estimated to be significantly higher for VTB Group banks compared to Sberbank PJSC.

Example above, we posit, provides additional reason for the necessity of developing methodological framework of strategic value management for banking real estate portfolios as part of their capital for entire Russian banking system for the purposes of enhancing overall banking system stability.

6. Directions for further research on strategic value management for banking real estate portfolios

As demonstrated in the previous chapters of this study, real estate as an asset class plays an important and multi-faceted role in the banking system, i.e. real estate owned or rented and used in operational activity comprises considerable portion of banks’ capital (including through the inclusion of positive revaluation of the real estate portfolios held as fixed assets as part of the banks’ Tier II capital) and represent one of the largest banks’ expense items (second only to personnel expenses – as part of the banks’ real estate portfolios referred to as “corporate real estate” in international academic studies),

On the other hand, real estate repossessed by the banks as part of working out bad debts also affects their real estate portfolios and may create a negative effect for banks’ capital when not disposed of timely due to difficulties of either determining its fair value, properties low liquidity or the necessity to create provisions for losses on the banks’ balance sheets (i.e. real estate repossessed).

Furthermore, in view of overall crisis conditions and the need to improve capital ratios, banks often identify a separate real estate category within their portfolios, i.e. investment real estate, which is intended to generate additional rental income and / or provide capital appreciation thereby improving banks’ capital adequacy.

Each aforementioned category of real estate within banks’ portfolios has its own characteristics and separate management instruments, as well as accounting and management accounting specifics that separate them from each other (i.e. corporate real estate owned is accounted for as part of fixed assets on the basis of value at recognition minus accumulated depreciation, while investment real estate is accounted for on fair value basis assessed by professional market appraisers).

Real estate multi-faceted role as an asset class in banking sector stability underlines the necessity for an in-depth academic study in the field, as well as competent management practices in order to manage risks of the banking industry instability and demands an application of systemic approach towards corporate real estate portfolio management, its analysis and risk management.

Proposed strategy of banks real estate formation and development – therefore should be a comprehensive system of value management aimed at facilitating shareholders’ interests by meeting the following conditions:

1) Quantitative and qualitative structure of the real estate portfolio is necessary and sufficient for bank’s operational activity as well as aligned with shareholders’ approved long-term plan;

2) Current return on capital, invested in real estate portfolio (current economic benefits – capital expenditures – operating expenses) is positive (P&L> 0);

3) Market liquidity and market value of the real estate portfolio is maximized during disposal though Highest and Best Use for local real estate markets (i.e. each property represents, whenever possible, prime asset within its local real estate market segment);

4) All properties comprising real estate portfolio, necessary for operational activities and not representing prime assets within their respective local market segments, are converted from ownership to leases;

5) Design, construction, fit-out as well property maintenance are centralized and undertaken in accordance with approved corporate standards ensuring positive effect on bank’s image on a contemporary requirements level (i.e. sufficient level of technology, innovation, environment protection and energy and economic efficiency as well aesthetics).

Suggested target indicators for strategic value management for banking real estate portfolios are listed in the Table 3 directly below.

Table 3. System of indicators for strategic value management for banking real estate portfolios

Indicator |

Indicator methodology |

Target value |

1. Share of inefficiently utilized real estate assets, % |

Usable area of properties above target portfolio divided by total real estate portfolio usable area |

< 5% |

2. Share of illiquid and low investment grade real estate assets owned, % |

Usable area of illiquid and low investment grade real estate assets owned, divided by total usable are of the real estate portfolio |

< 10% |

3. Operating efficiency |

Operating costs divided by operating income (C / I) |

< 1 |

4. Return on capital, adjusted for risk of real estate portfolio ownership |

Operating income divided by current real estate portfolio book value, excluding revaluation of real estate portfolio and provision for losses |

> Inflation rate |

5. β-coefficient (how real estate portfolio measures against the real estate market)?) |

Weighted average of total market value of the real estate portfolio market value divided by average market prices in respective market segment |

>1,20% |

6. Group of the indicators of real estate portfolio size repossessed by the bank as part of the bad debt workout procedures |

6.1. Size of the real estate portfolio repossessed by the bank relative to operational real estate portfolio 6.2. Size of the real estate portfolio repossessed by the bank relative to bank’s total assets |

6.1. <30% 6.2. <0,5% |

7. 6. Group of the efficiency indicators for real estate portfolio repossessed by the bank as part of the bad debt workout procedures |

7.1. Real estate portfolio turnover 7.2. Recovery rate for for bad debt |

7.1. Average duration of the real assets residing on bank’s balance sheet <1 year 7.2. According to industry practice, but generally above 60% |

System of indicators for strategic value management for banking real estate portfolios is comprehensive and balanced (i.e. includes indicators for both operational portfolio and real estate portfolio repossessed by the bank as part of the bad debt workout procedures), it is however can be adjusted and adapted to the particular bank’s business model as well as changes in banking regulations.

As a result, we propose to consider bank’s customer satisfaction in bank’s core services as one of the main factors driving overall real estate portfolio value as well the quality of management of the real estate portfolio repossessed by the bank as part of its bad debt workout procedures.

It is, however, important to note that highest and best use of each real estate asset can be different from the same determined as part of the entire portfolio or a group of assets. We therefore posit that central criteria of highest and best use of maximizing each and every asset value should be replaced with criteria of maximizing value of bank’s value a business, which, when achieved, will represent the highest real estate portfolio value as a result.

On the basis of the above, it is therefore proposed to understand highest and best use of the bank’s real estate portfolio as a legally, physically and economically complex entity, the use that maximizes bank’s overall value as business by optimal allocation of the bank’s real estate assets.

7. Suggestions for development of tactical methods and instruments of banking real estate portfolios value management

Given demonstrated positive correlation between the real estate markets’ volatility and corresponding financial stability, we believe it is necessary to study subject further and resolve a set of academic and practical problems aimed at creating consistent methodological framework for managing large, geographically distributed banks’ real estate portfolios as well as building a system of real estate market monitoring, analysis and forecasting for the purposes maintaining bank’s sustainable capital base.

Table 4 demonstrates broad directions of further development of theoretical and practical instruments of facilitating strategic imperatives outlined in Chapter 6 of this study.

Table 4. Broad directions, methods and instruments of banking real estate portfolio value management

Directions |

Methods |

Instruments |

1. Determination of quantitative and qualitative structure of the banking real estate portfolio |

1.1. Preparation of banking real estate register including properties location, type of property, area, intended use, property title (including land), its legal status (quality of property rights, registration status, i.e. rights are registered or not, status of cadastral records, encumbrances etc.), total costs of property maintenance, property taxes, rental expenses for property (including land), actual occupancy rate of the property |

Information and analytical tools: - IT-platforms for real estate portfolios management (i.e CAFM systems for corporate real estate portfolio) analytical databases - analytical instruments for property clustering - data visualization instruments (graphs and diagrams, spatial data visualization instruments) |

1.2. Preparation of spatial diagrams and maps demonstrating portfolio distribution over various economic and geographic regions (i.e. countries, specific regions and/or large cities) |

||

1.3. Determination of geographic focus points for drawing down or expanding portfolio and physical bank’s presence (i.e. more or less banking offices required to cover specific area of bank’s operations) |

||

1.4. Determination of properties, which are economically not viable, but socially significant (i.e. fulfilling bank’s social responsibility role and commitments) |

||

2. Real estate portfolio optimization |

2.1. Calculation of real estate portfolio actively utilized share |

Economic analysis instruments: - comparative analysis - correlation and regression - cluster analysis - spatial-parametric analysis |

2.2. Calculation of underutilized share of banking real estate portfolio and further analysis of its efficiency |

||

2.3. Prepare recommendations to optimize shares of actively utilized and underutilized shares of the bank’s real estate portfolio |

||

2.4. Forecast of the future changes in bank’s demand for real estate for its operations in view of expanding significance of online banking solutions |

||

2.5. Determination of future demand for physical offices by the bank’s clients – both corporate and retail |

||

3. Portfolio efficiency indicators assessment |

3.1. Calculation of the rate of return on capital invested in various groups of real estate within the bank’s real estate portfolio |

Financial analysis instruments: - return on capital rate - liquidity measurements - profitability rates - real estate valuation methods and techniques - management costs calculations |

3.2. Evaluation of liquidity and market value of each property comprising bank’s real estate portfolio |

||

3.3. Evaluation of liquidity and market value of the bank’s real estate portfolio as a whole |

||

3.4. Calculation of the costs involved in managing the portfolio |

||

4. Real estate portfolio legal support |

4.1. Formulating standards for legal support of real estate portfolio |

Legal instruments |

5. Optimization of owned vs. rented real estate ratio |

5.1. Determination of optimal rate of owned vs. rented real estate for banking operations based on international best practices and benchmarks (based on the comparative analysis with other banking groups as well as other operators of the large real estate portfolios with developed branch networks) |

|

5.2. Calculation of internal rate of rent for properties owned by the bank |

||

5.3. Roadmap preparation for transitioning from the current state to the target state of owned vs. rented real estate ratio |

||

6. Reengineering real estate portfolio management business processes |

6.1. Determination of the most efficient business process owners or managing bank’s real estate portfolio |

Business processes optimization tools: - business processes formalization techniques - business processes audit - business processes modelling techniques |

6.2. Determining methodology for transferring ownership of business processes from current owners to target (i.e. most efficient) owners |

||

6.3. Preparation of the methodological support for owners of the delegated business processes |

||

7. Evaluation and minimization of risks |

7.1. Identification and evaluation of risks associated with real estate owned vs. real estate rented |

Risk-management instruments |

7.2. Preparation of methodology of risks’ minimization |

||

7.3. Calculation of β coefficient value for various assets in real estate portfolio |

||

8. Improvement of existing assets and assets under construction |

8.1. Preparation of corporate standards for construction, fit-out and maintenance of all properties comprising real estate portfolio |

Technical instruments |

9. Instruments for efficient management of the real estate portfolio repossessed by the bank as part of the bad debt workout procedures |

9.1. Development of repossessed portfolio KPIs system 9.2. Determination of KPIs target values 9.3. Implementation of KPI system for managing real estate portfolio real estate portfolio repossessed as part of the bad debt workout procedures |

Portfolio-level instruments, including mass valuation methodology for revaluation of large homogenous real estate portfolios (i.e. large number of residential properties) |

Concluding remarks

1. Monitoring, forecasting and methods of managing negative real estate markets volatility impact on financial stability are important factors in preventing banking crises.

2. On an international level, this subject is among the key themes for research, including efforts by the Bank of International Settlements and respective academic and research circles.

3. There is an objectively presupposed consolidation of the Russian banking sector, which in turn may create corresponding concentration of real-estate related risks within the most systemically significant financial institutions and subsequently drive their appetite for real-estate related risks above what is considered benchmark for international banking groups. At the same time, we note a certain shortage of relevant research and methodology development on the subject matter.

4. Current regulations on valuation and accounting of banking real estate in Russia, in our view, contain certain legal and methodological inconsistencies that may inhibit their ability to fulfill a strategic goal of facilitating financial sector and, in particular, banking sector stability in their connection with systemically-significant real estate markets.

5. Comparative analysis of real estate assets of the Russian banking system and its most significant financial institutions provides an opportunity to evaluate risk and problem areas as well as outline further directions for research, crises prevention methods and offer strategic imperatives as well as prospective instruments and indicators for efficient management of banking real estate portfolios.

References

Fedotova M.A., Sternik S.G., Latkin F.A. 2017. “Current/actual problems of corporate real estate portfolio valuation.” Property Relations in the Russian Federation #1(184) - P.70-77

Fedotova M.A., Sternik S.G., Teleshev G.V. 2015. “Corporate real estate management methodology for real estate as part of bank’s assets and capital.” Management Sciences #4 (17) - P.62-70

Bank of Russia Regulation No. 448-P, dated 22 December 2014, “On Credit Institutions’ Accounting of Fixed Assets, Intangible Assets, Real Estate Temporary not Used in Operational Activity, Long-Term Assets Held for Sale, Inventories, Means and Objects of Labour of Undetermined Purpose Obtained under Compensation or Pledge Agreements”